TD Magazine Article

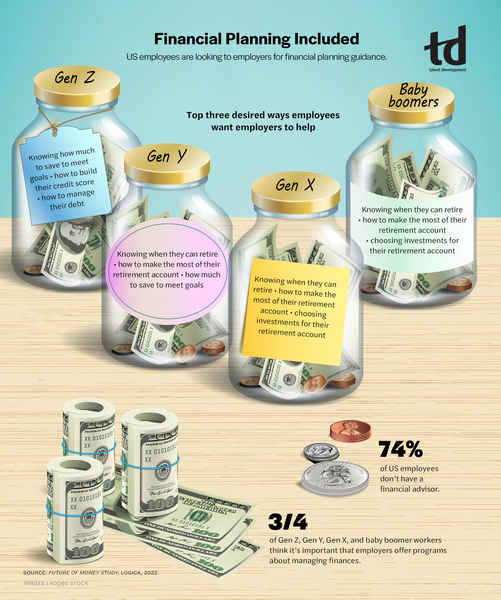

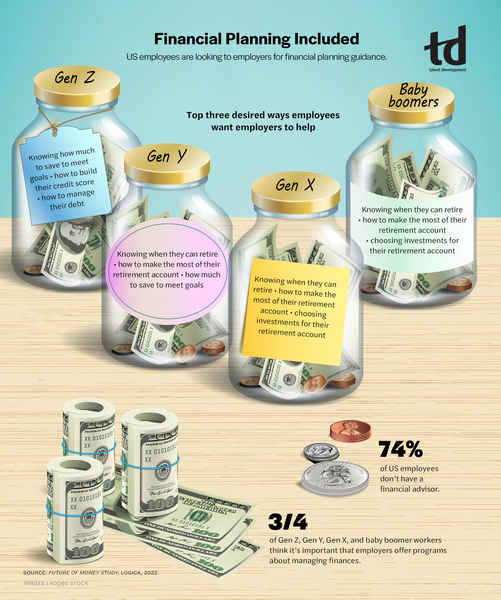

Financial Planning Included

US employees are looking to employers for financial planning guidance.

AS

By

Fri Apr 01 2022

Loading...

TD Magazine Article

US employees are looking to employers for financial planning guidance.

Fri Apr 01 2022